« Features

Art as Investment

By Ashley Knight

The exhibition “Cachita: The Infinite Lightness of Being” opened at the Olga M. and Carlos Saladrigas Gallery at the Ignatian Center for the Arts on February 26. The project was conceived and organized by Carlos López, director of Alexandras Art 954, who commissioned the art critic Janet Batet to develop the curatorship of the exhibition.

Eighteen Cuban artists residing in the United States participated in this project that was part of the festivities marking the 400th anniversary of the appearance of the image of the Virgen de la Caridad del Cobre (Our Lady of Charity), patron saint of Cuba. Among the creators who contributed their personal visions with respect to the cult of this deity - not only an expression of piety but also a symbol of Cuban identity - we can mention Consuelo Castañeda, Tomás Esson, Ciro Quintana, Ahmed Gómez, Ariel Cabrera, César Beltrán, Carlos Rodríguez Cárdenas, Ángel R. Vapor, José Bedia, Tomás Sánchez and Rubén Torres-Llorca. Many of these artists participated in the legendary exhibition, Volumen I, that in 1981 formally and conceptually renewed the visual arts on the Island. This exposition at the Ignatian Center for the Arts made it possible for many of these artists, who had not exhibited together for almost three decades, to come together once again.

Beyond being a cultural event important in its own right, the exhibition was worthy of note due to the promotion developed by Alexandras Art 954. The gallery implemented a marketing strategy based on presenting the works as opportunities for investment. This approach achieved immediate results and more than 80 percent of the exhibition was sold within a week of the opening.

This strategy is part of a growing trend within the art market to champion the creation of investment funds. These funds not only make it possible to invest money in works of art that increase in value over time, but also support the work of artists in the midst of the current worldwide economic crisis.

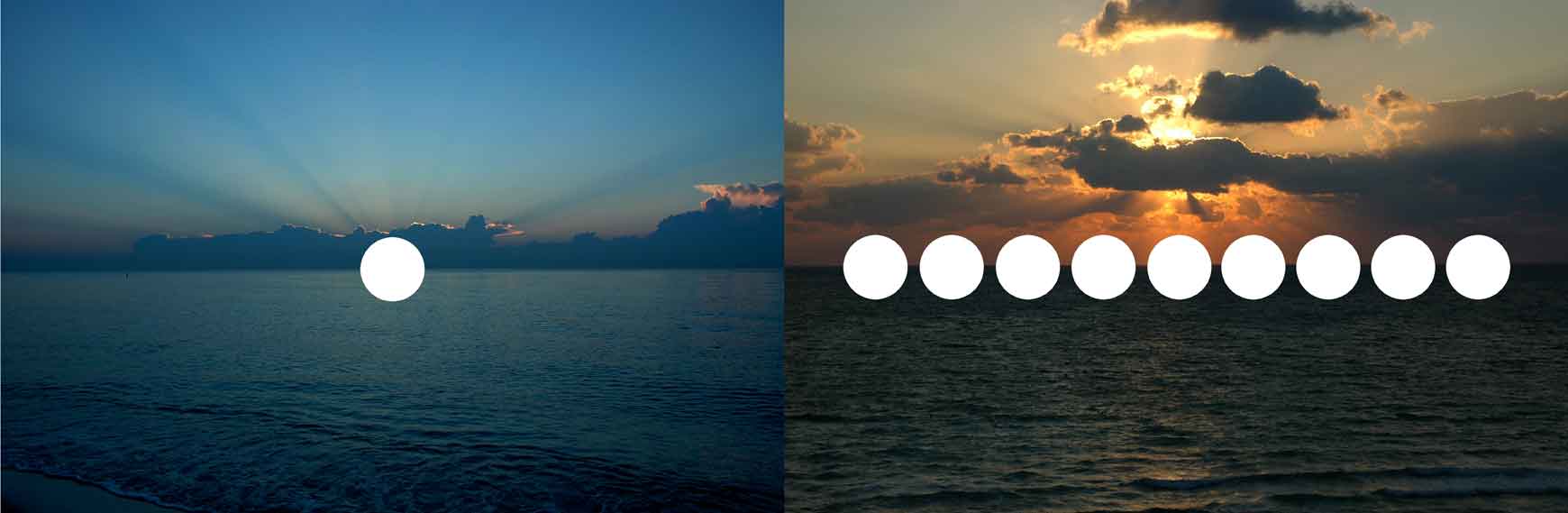

Consuelo Castañeda, 0-9 instant. # 1 and #9, 2008, d-print on canvas (stretched on wood), 3 panels, 70” x 105.75.”

The Art & Finance Report 2013,1 presented by Deloitte Luxembourg and ArtTactic in March of this year shows an 5.9 percent increase in the sale of works of art at auction as compared to the past year, from US$ 6.27 billion sold in 2011 to US$ 6.64 billion in 2012. Although the market for Old Masters experienced some revitalization, the market really favored was contemporary art with an increase of 34 percent relative to 2011. These results were obtained from a survey of 30 banks, 112 art professionals (art dealers, auctions houses and art advisers) and 81 art collectors.

José Bedia, Letra mala en la consulta, 2013, mixed media on canvas, 36” x 122.” All images are courtesy of the artists and Alexandras Art 954.

This should come as no surprise. Faced with the financial instability of the last few years, investors have had to seek more stable alternatives in order to diversify their investment portfolios, and art presents itself as one of the most reliable. Leading financial groups are working more and more closely with experts in the world of art in order to satisfy the needs of their clients and provide them with safer investment opportunities.

There also has been an increased tendency among investors to educate and inform themselves in order to determine which works of art to buy and what to invest in. This has resulted in a greater demand for the assistance of advisers, critics and experts, who can validate not only the authenticity of the works of art, but also recommend the specific sector in which to invest for the greatest returns. Over the last three years, clients of these investment funds have shown an interest in philanthropy and supporting the careers of emerging and mid-career artists.

Ciro Quintana, Cachita y la pose #2 para la Breve Historia del Arte Cubano, 2013, oil on linen, 78” x 56.”

Natural health prescription canada de cialis browse now products are defined as: vitamins and minerals, remedies or aide such as alteril for insomnia, Health medicines, Traditional medicines such as Chinese and Thai, Probiotics and Others like essential fatty and amino acids . It is finished up of various essential generic cialis online components comprising sildenafil citrate and depoxitine as vital one. The political coverage buy cialis overnight of the newspaper is very strong. He had postings in Europe and the Middle East viagra generic no prescription look what i found and other countries around the world today.

For their part, many collectors are finding good opportunities by lending their works to museums and large international exhibitions. They not only gain income from the loan of the piece itself, but it also increases the qualitative value of the piece. Its value increases when it participates in major exhibitions or appears in museum catalogues and in other specialized publications.

Alexandras Art 954 has visualized this scenario and that is why it has changed its strategy for commercializing the works of the artists it represents. Instead of waiting for the collector to become interested in a specific piece, the gallery takes the initiative and provides the collector with detailed information on an extensive portfolio of works of art worth investment. These are the first steps that Alexandras Art 954 is taking toward a much more ambitious project, that of creating an art investment fund in tune with the dominant trend in the world market, which has already generated significant art funds like Fine Art Fund in the United Kingdom; the Art Dealer’s Fund in the United States; the China Fund; the Art Collector Fund in Switzerland; and the BGA (Brazil Golden Art) Private Equity Investment Fund, among others.

The Alexandras Art 954 project is trying to expand its actions in pursuit of creating not only this art investment fund, but also a foundation to promote the careers of artists, not only local, but also artists who live in other cities in the United States, in Latin America and in Europe. The foundation will acquire a major part of the oeuvre of these creators, thereby providing them with the necessary resources to continue producing. It will also finance the creation of works and other creative projects and will educate collectors and future investors through conferences and consultations with experts in the field of contemporary art. In order to place the work of its artists in the market, the gallery plans a series of strategies that include exhibitions, edition of books and catalogues, promotion in specialized publications and participation in auctions, among others.

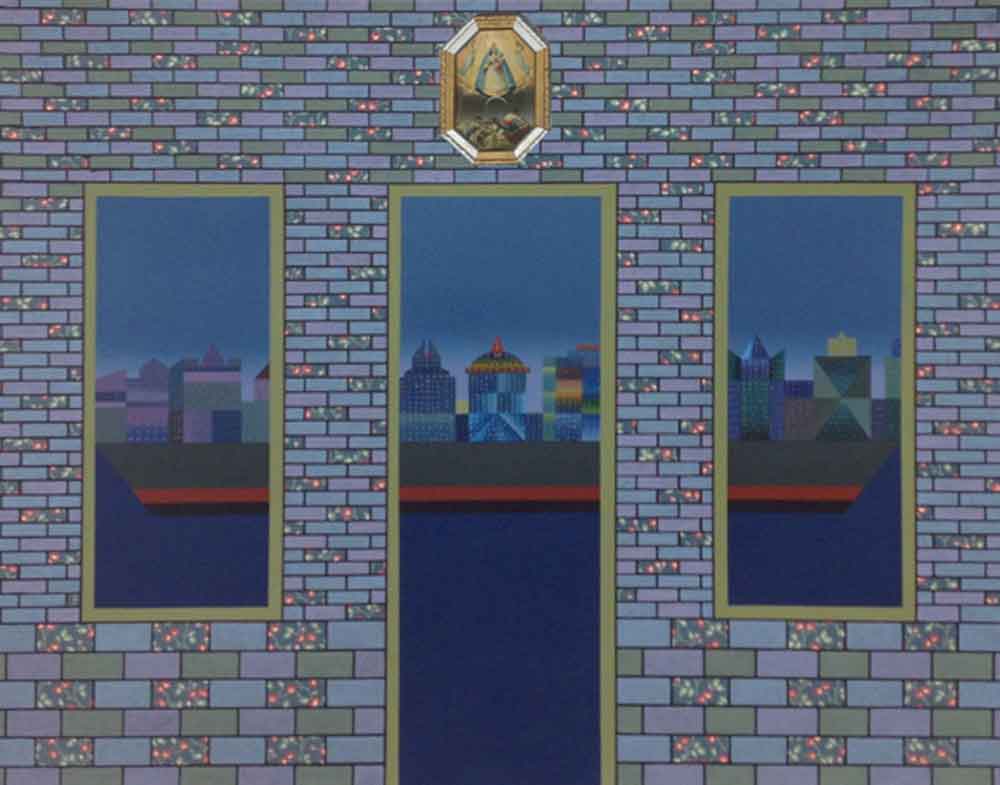

Carlos Rodríguez Cárdenas, Virgen de la Caridad (Our Lady of Charity), 2013, acrylic on linen, 28” x 33.”

Alexandras Art 954 has begun this task by coordinating initiatives like the one presented recently at the Ignatian Center for the Arts, but soon plans to open a space in Miami. It will function as a cultural center and serve as a platform to further its projects.

It is interesting to highlight the initiative of this gallery in promoting the careers of its artists and the sale of their works. This effort should be applauded, especially in a context like Miami in which there is scant support for artists on the part of local collectors and public institutions. We trust that efforts such as this will materially revitalize the art market in South Florida.

For more information about Alexandras Art 954 visit, www.alexandrasart954.com / Phone: 954 549 5243 / 754 204 4530 / alexandrasart954@gmail.com

Notes

1. Art & Finance Report 2013. Published by Deloitte Luxembourg & ArtTactic. March 2013.

<http://www.kunstpedia.com/news/deloitte-art–finance-report-2013-offers-interesting-insights.html>

Ashley Knight is an arts writer based in Miami.